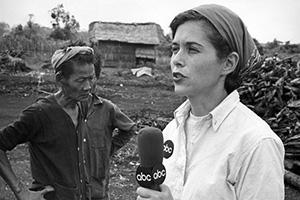

In 2015, CPJ formed the Sanders Society to honor the legacy of Marlene Sanders, one of TV’s first female journalists. Sanders, who worked in broadcasting for ABC News, CBS News, and PBS, was the first anchorwoman of a primetime network show, the first woman to report for a broadcast network from Vietnam during the war, and the first woman to be named to higher management of a news network.

Consider joining the Sanders Society and leaving a legacy gift to CPJ, which will help us guarantee our future and defend the rights of journalists all over the world. As a member of the Sanders society, your name will be featured in our Annual Report.

It is important, should you decide to designate CPJ as a beneficiary, that you contact development@cpj.org to let us know of your intentions so we can list you as a member of the Sanders Society. If you’d prefer to remain anonymous, we can ensure your privacy as well. Informing us of your intent to make a legacy gift to CPJ helps our organization plan for the future.

Name CPJ in your will | Retirement plans | Donor-Advised Funds | Life insurance | Appreciated securities | Property and other assets

Name CPJ in your will

It’s easy to include CPJ in your estate plans. You may include a charitable bequest to CPJ when you are writing or revising your will or through a codicil, a separate document that amends an existing will. All charitable bequests are fully deductible from your gross estate.

The following examples are meant to illustrate a variety of bequest requests. Please consult an attorney to adapt this language to your individual circumstances as part of an overall estate plan. You may also use this simple tool to create your own will and then bring it before an attorney.

A specific bequest is a gift of a particular dollar amount or a particular piece of property. For example:

I bequeath (dollar amount or description of property) to the Committee to Protect Journalists (or its successor).

A residuary bequest is a gift of all or part of the property remaining in your estate after debts, expenses, and specific bequests have been paid. When you use a percentage instead of a specific amount, your gift will stay relatively the same in proportion to your entire estate, regardless of unexpected increases or decreases in its value. For example:

I give, bequeath, and devise (all, or XX percent) of the rest, residue, and remainder of the property, both real and personal, wherever situated, which I may own or be entitled to at my death, to the Committee to Protect Journalists (or its successor).

A contingent bequest is a gift that takes effect only if the primary beneficiary or beneficiaries of the bequest predecease you. For example:

If neither my husband nor any descendants of mine survive me, then I give, bequeath, and devise all of the rest, residue, and remainder of the property, both real and personal, wherever situated, which I may own or be entitled to at my death, to the Committee to Protect Journalists (or its successor).

As an alternative, you may also wish to designate CPJ as a beneficiary directly through your bank or investment company. Sometimes, for a bank account or a CD, a “pay on death” (P.O.D.) or a “transfer on death” (T.O.D.) provision must be filled out in order for CPJ to be guaranteed the funds. Your financial advisor or bank will be able to supply you with the appropriate paperwork.

Retirement Plans

You are able to transfer funds from your Individual Retirement Account (IRA) as a Qualified Charitable Distribution once you are 70½ or older. To make such a gift, you will need to contact your IRA administrator and ask for funds to be transferred to CPJ.

We are happy to provide any additional information to the administrator.

Donor-Advised Funds

A donor-advised fund is a tax-deductible charitable giving account that you donate to and invest in over time. There are many different types of these funds.

You can use the widget below to search for your donor-advised fund.

Life Insurance

If you own a life insurance policy that is no longer needed for the protection of your family or for other purposes, you may use it to make a gift to CPJ. The simplest way is to make CPJ both owner and irrevocable beneficiary of the policy, which would entitle you to an income tax deduction based on either the total value of the premiums paid, or the cash surrender value, whichever is less. An alternative is to name CPJ the beneficiary of a policy you receive through your place of employment.

Appreciated securities

Donations of stock and securities or cryptocurrency are gifts that can be made during your lifetime that, because of their appreciation, allow CPJ to forecast for our future, while also providing you with the added benefit of securing an immediate income tax deduction, as you will pay no capital gains tax upon selling the stock.

Here, you can download information to provide to your broker as you prepare to make the transfer.

Should you decide to donate securities, please consider contacting development@cpj.org to let us know what stock and how many shares you are transferring so that we are able to provide you with a letter of acknowledgment for tax purposes. Often, security transfers do not come with the donor’s name or contact information included.

Other assets

Other property may be donated to CPJ and may be designated as part of your estate plan. However, you may also make an immediate transfer of the property, if you so desire. In most cases, an appraisal of the property will be necessary. The tax benefits of such a gift may vary depending on the type of gift, so you will want to contact development@cpj.org to discuss your transfer of personal property in advance of making the gift.